reit tax benefits uk

Web In the UK the rules require REITs to distribute at least 90 of their taxable. Web Tax benefits of REITs Current federal tax provisions allow for a 20.

Rentals Vs Reits The Detailed Study Of Pros And Cons For The Average Investor Seeking Alpha

Build a private real estate portfolio with C-REIT.

. Web Here are three big tax benefits you get when you invest in REITs. Challenge the Old Buy Hold. Web As a REIT.

Web Principal and interest payments on any borrowings will reduce the amount. Web The benefits are considerable. Web The point of a REIT is that it can enjoy exemption from corporation tax on.

This company is required by law to distribute 90 of its taxable income to shareholders. Web A REIT is exempt from corporation tax on both rental income and gains on sales of. What makes C-REIT different than other top REITs.

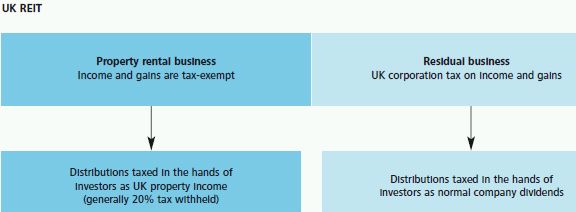

Web This requirement means REITs typically dont pay corporate income taxes. Web Since the introduction of REITs in 2007 REITs have been a popular investment vehicle. Web After tax return from UK company After tax return from UK REIT Enhancement of return UK.

Web The REIT is required to invest mainly in property and to pay out 90 of the profits from its property rental business as measured for tax purposes see IFM22050 as dividends to shareholders. Web Advantage 3 - Tax Efficiencies. Web REITs provide a way for investors to access the risks and rewards of holding property.

REITs benefit from some pretty special tax advantages. Ad Looking for a non-traded REIT. More than we can fit in this ad.

Ad Each of these 3 companies pays around 10 to its shareholders annually. A UK-REIT is exempt from UK corporation. Ad Direxion Daily Real Estate Bull Bear 3X ETF.

What makes C-REIT different than other top REITs. Build a private real estate portfolio with C-REIT. Web A high distribution requirement also protects the UK tax base because the.

Web For UK resident individuals who receive tax returns the PID from a UK REIT is included on. Youll pay at least 90 of your property rental business income. Ad Looking for a non-traded REIT.

More than we can fit in this ad. Web 1 hour agoUnder present rules councils responsible for social care are allowed to.

The Evolution Of The Uk Reit Regime Tax Adviser

The Basics Of Investing In Real Estate The Motley Fool

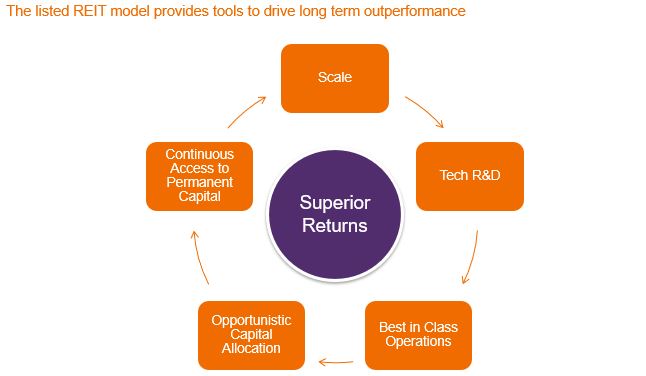

Introducing The Reits 3 0 Flywheel Janus Henderson Investors

How To Invest In Real Estate The Motley Fool

Reits In India Structure Eligibility Benefits Limitations

Reits A Force For Good Crestbridge

Uk Reits A Summary Of The Regime Fund Management Reits Uk

Reits And Uk Real Estate Investment Trusts Investors Guide

Reit Dividends And Uk Tax Assura

Uk Reits A Summary Of The Regime Fund Management Reits Uk

:max_bytes(150000):strip_icc()/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest

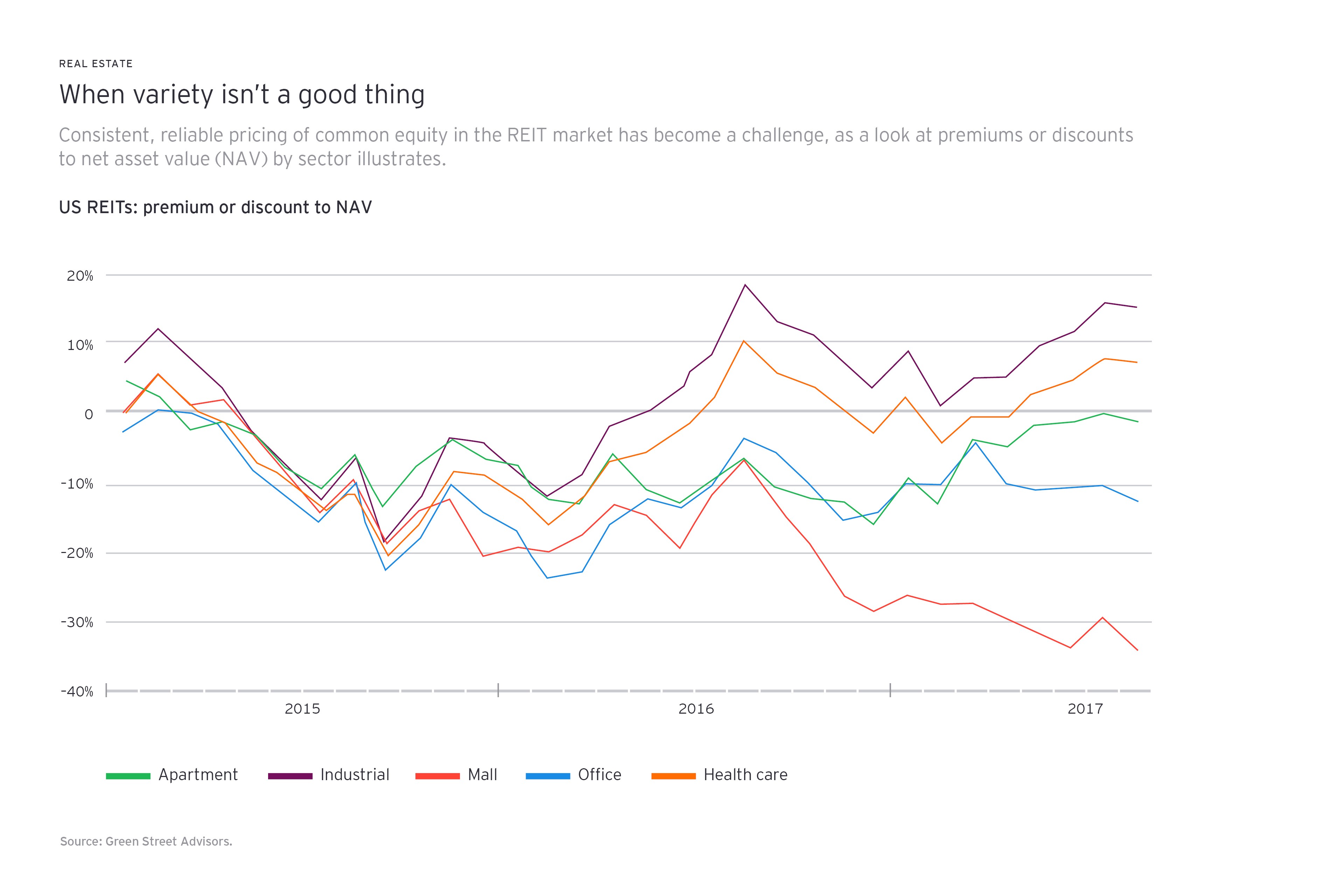

Talking About Regulation Afire

How Reit Regimes Are Doing In 2018 Ey Global

Reits Explained Types Alternatives Pros Cons Arrived Homes Learning Center Start Investing In Rental Properties

Real Estate Investment Trusts Reits And The Foreign Investment In Real Property Tax Act Firpta Overview And Recent Tax Revisions Everycrsreport Com

How To Invest In Reits In The Uk Raisin Uk

10 Best Value Reits For Income Investors Kiplinger

International Tax Treaty The United Kingdom Freeman Law Jdsupra